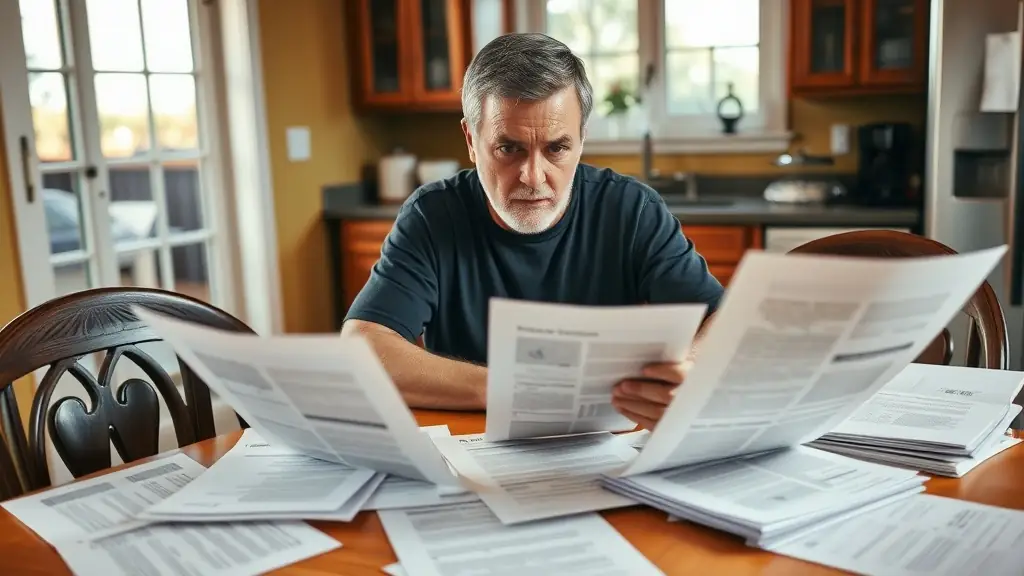

Pre-foreclosure occurs when a homeowner has fallen behind on mortgage payments, and the lender has issued a notice of default. This stage is critical as it gives homeowners a chance to rectify their situation before the property is officially foreclosed. During this time, homeowners should be proactive in seeking assistance and exploring their options. Understanding the timeline and implications of pre-foreclosure can empower homeowners to take control of their circumstances.

One of the most important steps during pre-foreclosure is to communicate with the lender. Many lenders are willing to work with homeowners to find a solution, such as loan modifications or repayment plans. Homeowners should gather all relevant financial documents and be prepared to discuss their situation openly. Additionally, seeking help from organizations like the Foreclosure Support Network can provide valuable guidance and support during this challenging time.

It’s also essential for homeowners to explore alternative options, such as selling the property or renting it out. These strategies can help alleviate financial pressure and prevent foreclosure. By understanding the pre-foreclosure process and taking proactive steps, homeowners can navigate this difficult period with greater confidence and clarity.